MT Department of Revenue Property Appraisal Notice Information

The Montana Department of Revenue recently sent out property appraisal notices that raised concerns for many property owners. To address these concerns, the DOR has planned a series of public meetings on their property valuation process and how they determined the new values. (see the link below to the appraisal notice information and meeting schedule)

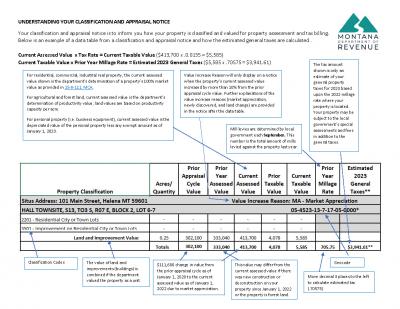

When reviewing the appraisal notice, you will see the tax estimate is based on the new taxable value and last year’s millage rate. Last year’s millage rate, however, is based on last year’s taxable values. Property values have risen dramatically across the board. The current year’s tax base will be much larger than last year’s, and taxing jurisdictions will most likely assess fewer mills of taxes.

If your notice indicates that your property’s market value increased over the past two years, this does not necessarily mean that your property taxes will increase by the same percentage. Montana law, 15-10-420, MCA, provides for limitations on the amount of property tax that can be collected.

- Information About Your Property Appraisal Notice https://montana.servicenowservices.com/citizen/kb?id=kb_article_view&sysparm_article=KB0013692

- Property Assessment Townhall Schedule - https://montana.servicenowservices.com/citizen/kb?id=kb_article_view&sysparm_article=KB0018367